kentucky property tax calculator

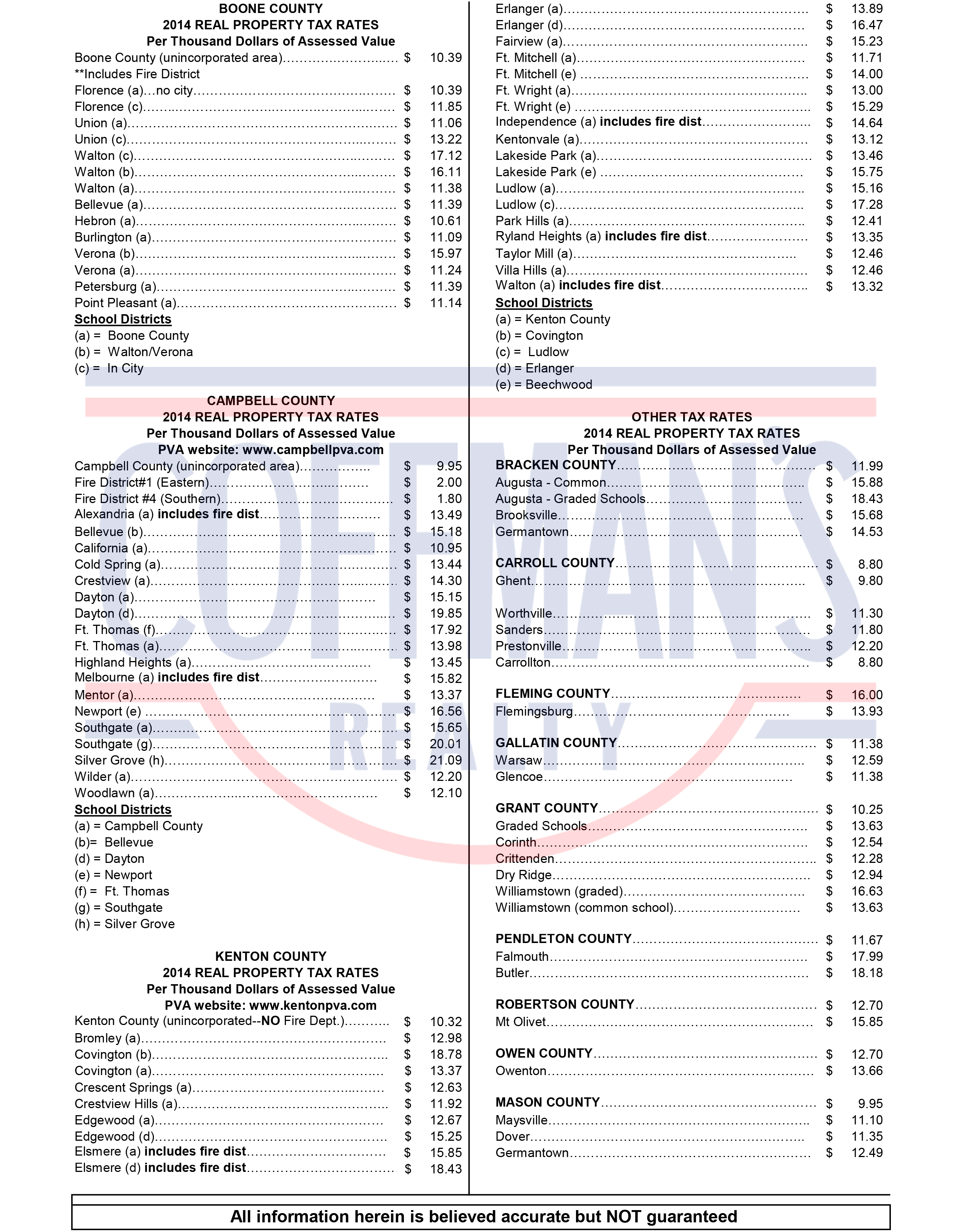

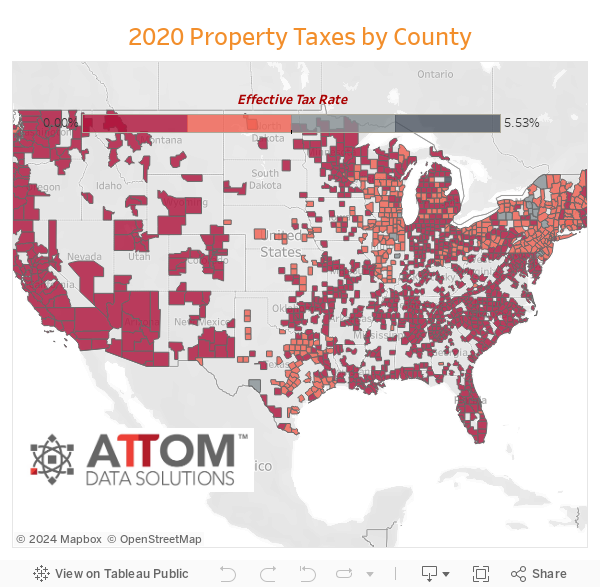

State law - KRS 132020 2 - requires the State real property tax rate to be reduced anytime the statewide total of real property assessments exceeds the. The highest property tax rate in the state is in Campbell County at 118 whereas the.

Usa Property Taxes For Foreign Nationals State Wise Guide

Overview of Kentucky Taxes.

. Actual amounts are subject. Assessment Value Homestead Tax Exemption. This calculator will determine your tax amount by selecting the tax district and amount.

Payment shall be made to the motor vehicle owners County Clerk. State Real Property Tax Rate. Maximum Possible Sales Tax.

Therefore the DOR Inventory Tax Credit Calculator is the. Average Local State Sales Tax. Inquiries on refund status can be sent to motorvehiclerefundkygov or by calling 502-564-8180.

The Property Valuation Administrators office is responsible for. That rate ranks slightly below the national average. At the same time cities and counties may impose their.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. These dates have been. The exact property tax levied depends on the county in Kentucky the property is located in.

For comparison the median home value in Grant County is. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Various sections will be devoted to major topics such as. If you are receiving the homestead exemption your assessment will be reduced by 40500. Kentucky has a flat income tax of 5.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The assessment of property setting property tax rates and the billing and collection process. Most Kentucky property tax bills do not separately itemize the tax on inventory from taxes on other categories of tangible property.

Check this box if this is vacant land. Maintaining list of all tangible personal property. Kentucky imposes a flat income tax of 5.

For comparison the median home value in Meade County is. The Kentucky property tax calendar provides a general outline of the major statutory due dates for various parts of the property tax assessment and collection cycle. For comparison the median home value in Kentucky is.

There are a total of 120 counties in the state of Kentucky and each county houses a different tax rate. Please note that this is an estimated amount. For comparison the median home value in Gallatin County is.

Aside from state and federal taxes many Kentucky. The tax rate is the same no matter what filing status you use. Overview of Kentucky Taxes.

Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. Different local officials are also. Property Valuation Administrators PVAs in each.

Oldham County collects the highest property tax in Kentucky levying an average of 224400.

Kentucky S Car Tax How Fair Is It Whas11 Com

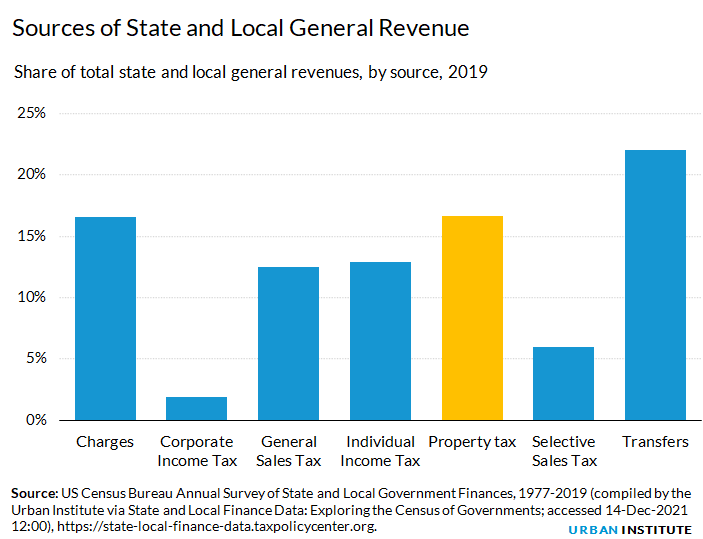

Property Taxes Urban Institute

Property Tax By County Property Tax Calculator Rethority

Clerk Network Department Of Revenue

Capital Gains Tax In Kentucky What You Need To Know

Jefferson County Ky Property Tax Calculator Smartasset

Tax Implication Of Owning Property In Another State In 2022

Kentucky Municipality Taxes Is There A Way To Simplify Inscipher

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Car Tax By State Usa Manual Car Sales Tax Calculator

The Kentucky Cpa Journal Tax In The Bluegrass Issue 1 2021 Kentucky Society Of Certified Public Accountants

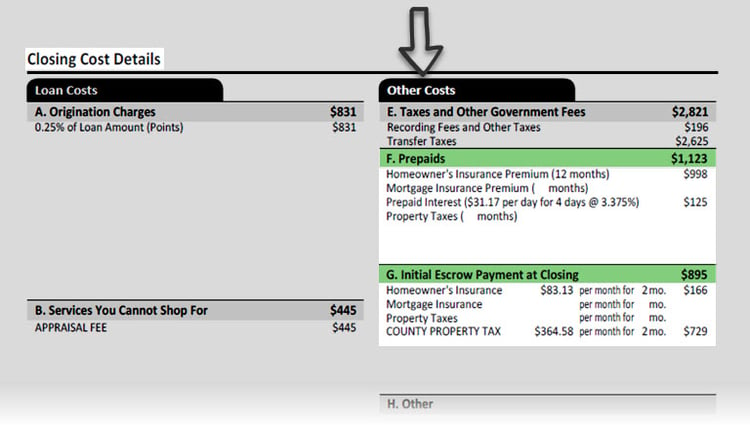

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Kentucky Property Tax Calculator Smartasset

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates